We just passed the 40th anniversary of the biotech industry, a birth made possible by the confluence of a seminal patent in recombinant DNA technology, the successful IPO of the first biotech company Genentech, validation of a Nobel Prize in Medicine and Physiology for recombinant DNA technology, and key legislation empowering academic institutions to commercialize their discoveries. Since then, many thousands of biotech start-ups have been founded — all with a focus on converting scientific breakthroughs largely from academia into new drugs and diagnostics for the benefit of patients suffering from devastating diseases.

Indeed, it is the dream of scientists to see their ideas transform into societal benefit, an aspiration that I shared as a young academic following the loss of my father to cancer. At the start of my career, I lacked the knowledge and experience to realize my goal but benefited immensely from the mentorship of others with entrepreneurial experience. My subsequent journey in entrepreneurship, highlighted by successes and failures, has provided me with insights into key elements needed for starting a biotech company and converting it into a sustainable enterprise. In this and subsequent articles, I will share some lessons I learned with the goal of helping aspiring innovators realize their dream of making an impact.

The Three-Legged Stool

Each year, governments, pharmaceutical companies, private equity, philanthropists, and institutions pour hundreds of billions of dollars into the development of drugs. Most innovative breakthroughs leading to these drug discovery programs are born in university laboratories where scientists study fundamental mechanisms underlying biology and disease. A very small fraction of these basic research discoveries will form the basis for new intellectual property that addresses an unmet medical need in a novel way and is actionable and sufficiently validated to attract the capital investment necessary to move it to the next stage of drug development. See “Protect Your Science and Its Impact.”

Two great breakthrough examples are the Nobel Prize-winning discoveries in T-cell regulation, which gave birth to cancer immune therapy, and in bacterial anti-viral mechanisms, which led to gene editing technology for the correction of inherited genetic disorders.

But the road to launching and building a new biotech company is fraught with risk and peppered with complexity and setbacks, both scientific and financial. As a science innovator, you might think “Who better to start a biotech company than scientists who are adept at navigating research’s winding path of sidesteps and restarts every day?” However, tenacity is not enough. What’s needed is the three-legged stool of bioentrepreneur success:

1. Assembling the right team with diverse expertise

2. Building on novel, validated science

3. Securing smart capital

People: Assemble the Right Starting Team

Advancing groundbreaking science through the rigorous multi-year process of creating and testing a drug requires the right people at the helm. Successful funding and drug development are more likely to come to academic inventors who recognize the limits of their knowledge and seek talented leaders to complement their skills. Assembling a strong mix of top science advisors, seasoned drug hunters, project managers and business experts enhances opportunities to secure top-tier funder capital.

Founder. The founder(s) are ‘central casting’ producers and the most important initial players who generate the breakthrough science and serve as catalysts for attracting quality capital and top talent. They can come from academia, industry, business, or other biotech industry organizations, and all can be effective to the degree that they passionately believe in the value of their science and vision, are ready to make an all-in commitment to the fruition of their dream, and are tenacious and humble enough to surround themselves with experienced and prestigious science advisors and skilled managers. In the eyes of investors, the ideal founder has a strong reputation for scientific rigor and excellence, possesses high personal integrity and resiliency, is a collaborative colleague and experienced team builder, and has the exceptional communication skills needed to articulate an aspirational vision.

First time founders with no financial or business experience must learn the ropes of valuing the startup business and estimating the capital needs, wooing investors, and securing IP in-licensing terms that are mutually advantageous to the academic institution, the company, and the investors. In my experience, I’ve relied on the collective support of experienced mentors, preeminent scientific advisors, respected board directors with biotech experience, and seasoned chief executives who have essential leadership and business experience in early-stage life science company formation, and who possess a track record of fundraising and business negotiation.

If you’ve arrived at a point in your research career where you’re ready to launch a company, you no doubt already have a strong mentor in your corner. Mentorship by individuals skilled in biotech entrepreneurship can elicit higher performance by educating and challenging founders and by making critical introductions. Mentoring matters. See my Leadership series.

In the very early phases of starting a venture, founding advisors with prior start-up experience can be helpful in setting up the corporation, negotiating an IP license from one’s academic institution, identifying full-time executives and scientists, surveying research space availability, and more. Ideal founding advisors are often retired CEOs, biotech lawyers, and/or business development executives. It may also be necessary to identify an accountant and project manager. Support for these individuals does not involve cash compensation and can instead be motivated with founding equity, typically ranging in 0.1 to 1% of the company. Often times, these individuals will transition to a part-time or full-time leadership role in the company or serve on the Board of Directors once funding is secured.

Leadership. Early formation of a life science company typically involves the founder and one or two co-founders with complementary scientific and industry experience in drug development, who together develop a scientific, operational, and financial plan. Armed with such a plan, licensed IP and know-how, this founding team seeks ‘seed’ funding to establish a legal entity and laboratory operations. Seed funding can come from the founders (which inspires confidence from investors), their friends and family, angel investors, and non-dilutive sources such as grants.

As the company advances, it is critical to hire a Chief Executive Officer (CEO) who understands early-stage biotech culture and possesses great communication and recruiting skills as well as business and financial knowledge. Key roles of the CEO will change as the company moves from early preclinical stages to clinical trials and ultimately to commercialization. In the early stages, the ideal CEO creates advantage by bringing a high profile, understanding science, possessing the credibility to attract and sell potential investors in funding the new business, and the ability to bring in the right talent to fulfill other leadership roles. The CEO also works closely with the founder to manage any Scientific Advisory Board and Board of Director meetings so that they are productive. It is also worth noting that some founders can themselves successfully transition from their academic positions to a leadership role in their start-up company, usually as the founding CEO or CSO. There are plenty of successful examples of this, but again, it takes a commitment to learn the business aspects of the enterprise and a willingness and ability to build a team of experienced executives and advisors with diverse expertise.

Other leadership functions to be filled as the fledgling company gains early investment and moves to the clinic include a Director of Product Development, Chief Medical Officer, and Chief Financial Officer. Also critical is a strong Chief Business/Operations Officer to oversee compliance, regulatory affairs, IT, HR, and Facilities, and to participate with the CEO and founder in business planning and financing.

Board of Directors. The Board of Directors is a legal entity focused on business aspects of the new company, including business, operation and funding, strategy, and dealing with new strategic opportunities and any setbacks. The Board has the fiduciary responsibility to preserve and protect the new corporation, including but not limited to the hiring and firing of the CEO. The CEO and the Board chairperson work closely together to develop agendas for director meetings, discuss agenda items ahead of time with the Board’s members, and set the tone for effective decision-making that serves the best interests of the firm above all else. The Board is made up of the shareholders, the CEO, and the founder. Good governance also involves inclusion of at least one independent Director. Boards should consist of members with a diversity of skills and perspectives spanning scientific, drug development, clinical trials, business development, finance, and legal expertise.

Novel Science

Great companies are built on the foundation of exciting, impactful, and validated science protected by multiple patents in multiple countries. See “Protect Your Science and Its Impact.” The optimal company profile for attracting top-tier Series A investors is one with a late pre-clinical or lead drug development candidate, a very strong team to drive drug development to the clinic, and a discovery platform that can generate a pipeline of additional drug discovery programs. These discovery platforms mitigate the enormous risks involved in drug discovery and development and, as such, offer avenues for securing critical non-dilutive funding for financial sustainability. Moreover, a lead drug development candidate with multiple disease indications can further mitigate risk and increase valuation for your startup as well as provide broader opportunities for licensing contracts and investment transactions. (1)

(1) Emmerich, Christoph H; Gamboa Lorena Martinez Hoffman, Martine CJ Hoffman; Bonin-Andresen, Marc; Arbach, Olga Schendel, Pascal; Gerlach Björn Hempel, Katja; Bespalov, A; Dirnagl, Ulrich; Michal J. Parnham. Improving target assessment in biomedical research: the Got-IT recommendations. (2020) Nature Reviews Drug Discovery Nov 26;65-81.

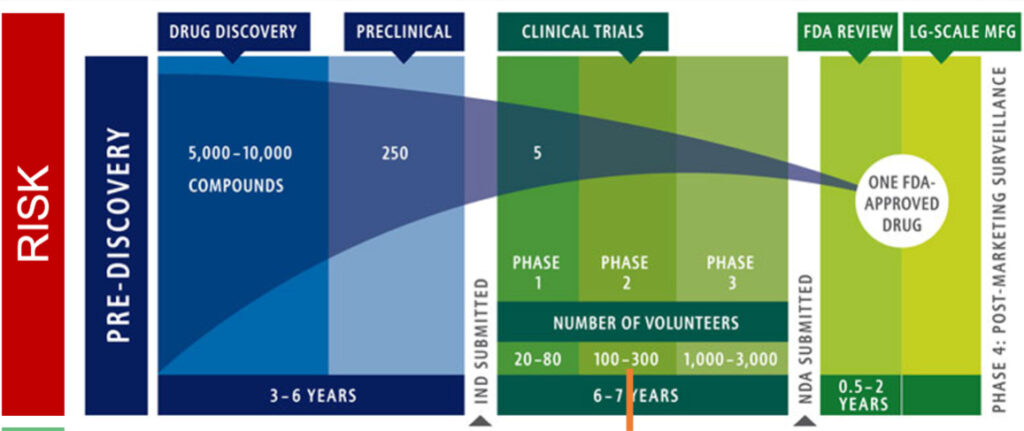

You are no doubt familiar with the lengthy and costly phases that your science will have to traverse to ultimately yield a drug proven to be safe and efficacious enough to win US Food and Drug Administration (FDA) approval. As shown in Figure 1 below, shepherding your science through drug development to preclinical proof of concept and thence through successful pivotal clinical trials will take years. The most successful long-term companies are those that conduct thorough validation of drug targets and drugs at early preclinical stages of development to reduce the frequency of failures at more costly clinical stages and at NDA (New Drug Application). In the preclinical stages, typically single digit millions are needed to create a lead drug development candidate, followed by $10-15 million for IND-enabling (Investigational New Drug Application) and Phase 1 studies, and ultimately $150-300 million to complete pivotal clinical trials.

Figure 1. Phases of Investment for Cancer Treatments

Source: Adapted from Intercept

Just as with any research effort, setbacks are to be expected. But I believe academic research centers can increase the probability of long-term success by better integrating rigorous discovery science, professional drug discovery, and clinical knowledge in order to create highly validated, de-risked preclinical programs that can form the basis for a new company. Such academic efforts can help to partially traverse the ‘valley of death’ that spans from preclinical to early clinical proof-of-concept and can reduce the rate of failure for companies and their clinical trials, thereby benefiting patients. Prototypes for such programs are the Institute for Applied Cancer Science at MD Anderson and the Belfer Institute at Dana-Farber, which I founded to address problems in this process by accelerating those basic research programs with the highest likelihood of clinical impact and success. The numbers underscore the need for such translational programs. Although acquisition and IPO deals hit record highs in 2020 (2) IPO markets for most of the 2000s were subdued and venture investments climbed slowly in the last ten years. (3) (4)

(2) Financing breaks all records in 2020.”Nature Biotechnology. (2021) Feb;39(2):133-134. doi: 10.1038/s41587-021-00817-7.

(3) Melanie Senior. “Biotech bubbles during the global recession.” Nature Biotechnology. April 2021. 39,408-413. https://doi.org/10.1038/s41587-021-00876-w.

(4) Bruce Both. “Evolution of the Biotech IPO Markets: from Busted to Booming.” Forbes. Sep 21, 2020.

The relay race from Phase 1 clinical trials to a successful NDA has a 95% failure rate. The science yielding compounds that go into clinical trial are often, in my opinion, not stringently validated at the preclinical level. Academia is best positioned to serve this role. I believe that insufficient validation and lack of a strong patient responder hypothesis contributes to the sad failure rate often cited: that 19 out of 20 startups will fail. (5)

(5) Misa Landau, “An Interview with Ronald DePinho.” Clinical Chemistry. 59:1, 11-17, 23

Founders would all like to beat these odds, to gain knowledgeable investors ready to fund paradigm-shifting technology akin to the 1973 breakthrough of recombinant DNA, continually weighing the possible multibillion-dollar potential of a major new technology against the multibillion-dollar price tag and high risks. The first challenge is to present a strong foundational science platform.

One caution: Make sure you’ve secured your intellectual property before you approach investors, and even then, be circumspect in your funding pitches and negotiations. And, of course, have all of your ducks lined up before any publication of your science. See “Protect Your Science and Its Impact.”

Capital Funding

If your science is unique and replicable with paradigm-shifting or practice-changing potential, you now must realistically assess the technology’s market, project the costs of bringing it through the early years of discovery and development, secure funding, and determine possible exit points for shareholders. Your goal is to gain the financial backing and skillful advice of experienced biotech investors and entrepreneurs. To commercialize your science, your founding team must include individuals with the business and financial acumen to project capital needs at each phase in this cycle.

The late great Henri Termeer, founder of Genzyme and the longest-tenured entrepreneur of any biotech company, offers this advice to would-be biotech entrepreneurs. “Not only do you need to conduct great science,” he writes, “you need to have a time continuum long enough to research the problem and complete the work so you can make it successful. The length of time you have to do this is ultimately determined by your financial strength.” (6)

(6) Henri A. Termeer, Biotechnology Entrepreneurship: Starting, Managing, and Leading Biotech Companies,” Elsevier. 2014, pg. 15.

In the earliest start-up phases, pre-seed capital enables fundamentals such as establishing your corporation and legal documents, applying for intellectual property protection, hiring your first employee(s), and developing your company’s brand and pitch materials. Capital needs for this early company formation phase can range from $100,000 up to about $500,000, usually sourced by investments from the founder, angel investors, family, friends, and non-dilutive funding sources such as grants. Equity stakes exchanged for these funds are small and typically in the form of a convertible note. Each successful phase of drug development will involve greater risk, so the investors you approach will be increasingly more sophisticated and will require more ownership in exchange for their cash and their company-building skills. They will put their own value on a company, which will determine their investment decision, exit timing, and how much equity they require. If you find and complete deals with the top-tier biotech-sector investors, they will give you much more than funding. They will also offer critical expertise in navigating the complex development process, connecting you with important resources and recruiting top management to your firm.

Discovery and Development. The first phases of drug development can take years. Your initial funding underwrites laboratory research to discover and validate lead small molecule compounds by compound screening assays, or lead antibodies by various discovery platforms. After initial identification and validation, these initial scaffolds or antibodies are subjected to rounds of medical chemistry or humanization/optimization to improve the potency, pharmacokinetics, and safety of the compound with the goal of ultimately nominating a molecule or antibody for clinical development, the so-called ‘lead clinical candidate.’ This validated lead drug, which has verified biological activity in preclinical model systems, is then subjected to IND-enabling studies that include optimal formulation, synthesis or cell line development protocols, toxicity testing in animals, and pharmacokinetics studies of absorption, metabolization, and interactions with other drugs — all with the goal of first-in-human studies. The goals of preclinical development are to achieve pharmacologic proof-of-concept of animal safety and efficacy and to define as precisely as possible a patient population most likely to respond.

The initial seed capital needed for the development of a lead clinical candidate or antibody ranges from $5-10 million. For IND-enabling studies and Phase 1, Series A preferred financing is the typical investment route with the cost per asset at $12-15 million for a small molecule and $15-18 million for an antibody. These numbers are in the lower range and assume a highly efficient and experienced team and significant leveraging of CROs (Clinical Research Organizations). In addition to investor sources, non-dilutive grants can provide increased financial runway and mitigate risk. One of the best mechanisms is the NIH SBIT/STTR grant mechanism, which provides $250,000 – $400,000 for Phase 1 grants for early preclinical studies, $2 million for Phase 2 grants for late preclinical development, and $4 million for IND-enabling and Phase 1 clinical studies. It’s important to explore other non-dilutive funding sources. In Texas. for example, the Cancer Prevention and Research Institute of Texas (CPRIT) program offers $3 million grants for preclinical studies and $20 million grants for early clinical development studies. These CPRIT grants focus exclusively on companies domiciled in Texas or willing to relocate to Texas and usually have a matching requirement of 50% investor funds; i.e., a $20 million CPRIT grant would require $10 million investor funds.

Series B funding is typically in the range of $30-60 million and provides funding for early clinical PoC studies (Phase 1 B and Phase 2), as well as support for the development of pipeline drugs. This financing stage is followed by a crossover round and IPO, which typically secures the $100-200M needed for pivotal clinical trials and transition of the pipeline drugs into early clinical trials. IPOs are typically complemented by co-development deals with large biopharma companies, which can provide sizeable upfronts of $50-100M plus milestone payments in the hundreds of millions of dollars. In return, start-up companies must grant commercialization rights and royalties to the biopharma.

Valuation

Before approaching any investors, you must formulate your desired deal terms. So you will need to know the potential value of your company and assets, based on realistic assessment of costs and market potential. You may be so excited by the research that it seems unquestionable to you that there will be enormous demand for your invention. But right out of the gate, put aside those expectations and use your scientific skills to make hard-nosed calculations to reach a go/no-go decision. Market potential defines profit potential and is the core of all other calculations of business value. Even if your goal is to become a viable acquisition target as your product advances through clinical trials, you need to start with this assessment.

In calculating value, inexperienced biotech entrepreneurs often mistake total available market for how much actual market they can attain. Time and again, funding pitches paint pie-in-the-sky numbers that recognize only overall spending in a category, assume no competitors, and expect universal adoption by every single buyer in the category. What you should use is the subset of potential buyers most likely to purchase your therapeutic, grouped into one or more segments such as therapeutic need, therapeutic channels, price sensitivity, treatment modality, demographics, or other relevant criteria. You must also anticipate new standards of care that may impact your market.

Valuation experts specializing in pre-commercial life sciences firms can assist with valuation. But it is a highly subjective process. The most reliable quantitative method is analyzing future cash generation discounted for present value (NPV). NPV calculations, however, must also quantify and factor in highly subjective elements such as risk, cost, and the time it takes to reach the next stage of value. A more objective measure is the value of comparable deal transactions, for which many databases offer 3rd-party data.

Another approach for projecting possible valuation is comparable exits, but these measure the purchase or IPO values of mature companies in your category or in a comparable biotech sector to project possible valuation.

An upcoming article in this series will address this in more detail: “Considerations for Valuing Your Start-Up Company.”

Preparing to Pitch

Putting a value on your company is critical to negotiating a favorable and fair deal attractive to both you and your potential investor. But start by identifying suitable investors and do the preparatory work to approach and pitch them. For this discussion, let’s focus on funding for Series A/B rounds and beyond, where you will be looking for sizeable funding from a VC. An upcoming article in this series will address this in more detail: “Selling Your Company Idea: Preparing Your Pitch.”

It behooves you to identify and carefully research the venture capital firms you will approach and look at the deals they’ve made to understand their investment philosophy. Study as much public data on deal structures and values as you can find. What stage companies are they investing in? Are they in the beginning of a new fund? (If they are in later cycles and you require a large financial commitment with a long horizon, they are not likely to be in a position to invest at this time.) Are the research and business backgrounds of the principals close to your science? Talk with leaders of companies in the VC’s portfolio to ascertain the VC’s participation style, their return-on-investment horizon, their management modality, problem-solving orientation, and their willingness and ability to provide strategic guidance and resources. Are they heavy-handed or reasonable in their approach to negotiations and to subsequent management of the relationship?

Keep in mind, too, that potential investors are quite experienced at valuation and are likely to come up with a pretty accurate window in their preparation for negotiations. They are likely to recognize if you’re highballing your ask. In the end, I am reminded of the ‘golden rule’ — he who carries the gold, makes the rules. Thus, having multiple investment offers can help preserve founder ownership and optimal terms.

Your Business Plan. First time founders often do not fully appreciate how critical business planning is or how to clearly communicate to investors why their game-changing innovation is such a good deal.

An upcoming article in this series will address this in more detail: “What Goes into a Solid Business Plan.”

Business planning is not a trivial exercise. You must be realistic about the chances that your breakthrough innovation will find commercial success (i.e., address an unmet medical need in 5 to 10 years) following a multiyear and multimillion dollar investment. So, start with the science and really define its true market targets, including the diseases and patients it will treat, competitive entries that are already adopted by doctors and approved on insurance formularies or are coming down the pike, and the advantages that your technology will offer over these current and future products. What are the characteristics of your target market segments and what distribution channels exist to supply the marketplace now? What is your burn rate at each stage and the anticipated inflection points at which you’ll require more funding? Define your existing resources, particularly the talent you’ve already attracted, and resources needed in the future. Finally, prepare your going-in valuation estimate and what you are asking for the current round of funding.

An upcoming article in this series will address this in more detail: “Project Your Funding Inflection Points and how You Will Manage Your Burn Rate to Stay Afloat”

This plan should be carefully vetted by your Board of Directors and, when ready, laid out professionally and summarized in a simple one-to-two-page executive summary for use as an introduction and request for the opportunity to pitch investment candidates. This summary is often accompanied by a nonconfidential pitch deck of 10 to 15 slides (see outline below). These documents should be concise and well organized, structured with a short introduction and mission, brief bios of you and your founding team members, a description of your science (drug and platform) and what market need it will solve, your competitive risk and how your technology will be different (and better) then those in the market or pipeline, your investment ask and use of capital with anticipated goals achieved, proposed follow-on rounds of financing and non-dilutive capital (e.g., grants), exit strategy, and likely return. Discussion of valuation should come after an expression of interest.

Your Brand. Well known senior research leaders already have personal brands in their field, as do science leaders associated with your venture. The business brand is separate, although it too will be associated with you as founder. Determine your unique selling proposition (how you will differentiate your product from others) and articulate your dream for the company in a mission statement.

Your company name and logo represent the brand. There are as many approaches to this as there are life science entrepreneurs. STAT News (7) published a great review of some of these, including:

(7) Eric Dolgin, What’s In a Name? How Drug Startups Choose Their Brand. STATNews. March 9, 2016.

- Basing the name on numbers in your target biological element

- Appearing at the top of company lists with a name picked for its position in the alphabet

- Using a historical, even ancient name

- Associating your brand with scientific parallels, such as shooting stars or gene structures

Gut feel frequently guides the process of coming up with a memorable name. So does the availability of the URL or the possible graphic rendering as an expression of your business’ identity. In fact, it’s the combination of the visual identity with the name that often defines your brand. This includes your logo, the visual treatment of the name (possibly with an icon and tagline), complementary colors, and fonts. The branding should also include ancillary elements, including treatment of photography, website, email templates, business cards, stationery, branded email names and signatures, datasheets or brochures, and any PowerPoint templates. It’s prudent to invest money and time on good design and content for these materials, and to ask your designer to provide a brand guideline that keeps the brand from being misused by multiple people. It’s also wise to subscribe to a branded digital automated signature platform for NDA and contract execution. Free versions typically won’t accommodate uploading your brand.

While you may be able to get away with a few hundred dollars from a friend, it’s worth it to spend more to hire a professional. Plan on a development time of at least two to four months and a cost of as much as $10,000 to $25,000 on a branding process that creates a professional image to impress on investors and talent that you are serious about your company. Costs vary widely, so get proposals from three companies before you select your branding partner. Working with smaller freelance firms is generally much less expensive than larger marketing agencies, but make sure you are comfortable with their skills and working style. Be sure to organize a streamlined process for this project. If you have a committee approach to defining and reviewing design and content, the process will be highly inefficient and could add considerably to both time and costs.

Pitch Deck. Now you can develop a one-to-two sentence elevator speech and assemble your pitch deck – a PowerPoint presentation that covers the essentials of your plan. The elements of a winning pitch deck are defined very well by serial entrepreneur Peter Thiel, cofounder of PayPal. (8) For my companies, I’ve used a structure similar to his, and condensed it as the content for my website, which in the early stages is accessible only by those with a unique URL and secure firewall with password.

Building on Thiel’s elements, I suggest these elements for the deck:

- Problem & vision

- Unmet need & potential market size

- Preclinical science: genetic and pharmacological PoC for lead asset

- Clinical hypothesis for lead asset

- Discovery platform & pipeline

- Raise & use of funds with milestones

- Financial timeline with subsequent financing, non-dilutive capital, & exit

- Founding team & management

- BOD & SAB

- IP portfolio

- Competition

Armed with this deck, presenters must rehearse – over and over again – until they are able to present professionally, without looking at notes, and with complete confidence and energy similar to that of a TEDx presenter. Your terms must be presented firmly, even if you decide to signal your negotiating ability based on market comparables. Remember, this is nothing like the Shark Tank reality show. You are not presenting rapid-style to multiple possible investors. You’ve carefully chosen this investment fund to pitch and, if they’ve invited you in, you have cleared the first hurdle and have a receptive audience to whom you must succinctly and enthusiastically sell your venture.

Put It All Together

This is just an overview for scientists looking to commercialize their discovery. Since my early days, I’ve learned a great deal. I’ve been fortunate to be surrounded by great mentors and colleagues who have launched many successful startups. Recently, I co-founded a new type of biotech company generator and enabler, Sporos Bioventures. Sporos, based in Houston and Boston, is led by a world class CEO, Amit Rakhit MD. He and his team provide management and capitalization guidance to its start-ups. (9)

Harnessing its global network, Sporos identifies and in-licenses transformative science, and provides start-ups with strategic resources and operational expertise. Sporos also maintains its own internal drug discovery engine for the creation of new companies.

I’m excited that one of the Sporos portfolio companies, Tvardi Therapeutics, recently secured a Series B financing of $74 million involving a consortium of top-tier investors, enabling it to move into clinical proof-of-concept trials across a number of disease indications. The company’s CEO, Imran Alibhai Ph.D. who is a highly-regarded scientist with considerable entrepreneurial experience, was key to securing the confidence of investors. Tvardi Therapeutics is a Houston company whose novel science grew from the academic laboratory of David Tweardy MD and is illustrative of the fertile research environment in Houston. This success is a nice example of bringing together all of the elements we discussed in this article.

This introduction to Biotech entrepreneurship only touches the subject’s surface. Hundreds of books and trainings in business incubators, accelerators, life sciences, and private training programs are devoted to helping life science researchers learn how to launch a company. In future articles, I will cover strategies to consider for maximizing your probabilities of success. Stay tuned and good luck.

Articles in the Biotechnology Entrepreneurship Series:

Biotechnology Entrepreneurship Series 1:

Biotechnology Entrepreneurship: Fundamentals for Academics Starting a Biotechnology Company

Biotechnology Entrepreneurship Series 2:

Protect Your Science and Its Impact